Treble Peak for

wealth managers

Introduce your clients to new growth opportunities they might not have known were in reach, while expanding your own appreciation of the possibilities offered by private markets.

cookie-law-info domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121add-search-to-menu domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121ultimate-blocks domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121wpforms-lite domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121salient domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121salient domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121pods domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121salient domain was triggered too early. This is usually an indicator for some code in the plugin or theme running too early. Translations should be loaded at the init action or later. Please see Debugging in WordPress for more information. (This message was added in version 6.7.0.) in /home/forge/treblepeak.approvalarea.co.uk/public/wp-includes/functions.php on line 6121Introduce your clients to new growth opportunities they might not have known were in reach, while expanding your own appreciation of the possibilities offered by private markets.

We forge close partnerships with a broad range of Europe’s top fund managers, giving your clients a choice of options to complement, balance and enhance their portfolio – from seed to late stage growth, funds to single company deals, and primary to secondary deal flow.

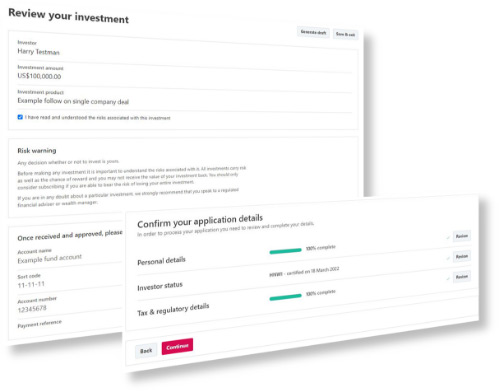

Whether your client is allocating as a corporate or private investor, Treble Peak’s digital approach is intuitive, efficient, and secure, from fund selection and subscription through to ongoing reporting.

For maximum simplicity and integrity, signatures can be captured, tracked and recorded with a choice of DocuSign or HelloSign.

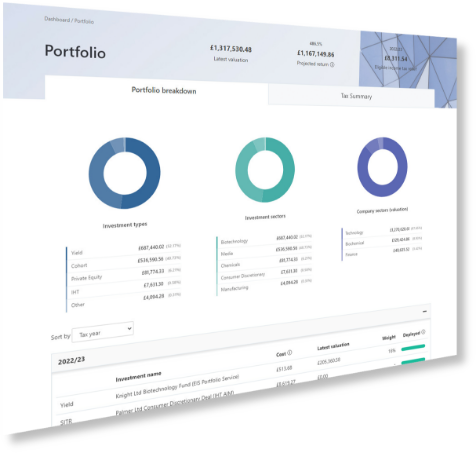

Thanks to intelligent integrations with our custodian, reporting on your investment is dynamic, up to date and entirely accessible through our secure platform, along with easy pdf downloads.

From customised training to your own dedicated account manager, we offer a range of technical and account support that can scale and adapt over time as your needs evolve.

Our Fund Philosophy has the following components:

We look for teams with deep expertise of their domain. Success tends to be a collective effort, so team stability and experience is important. We look for teams that have worked together over a long period of time and remain true to their DNA.

We want to see evidence that this domain expertise has been successfully translated into tangible returns for investors. This is not just about numbers but evidence that the teams have built the infrastructure to sustain success.

We like firms where the principals remain involved in the day-to-day investment decisions, where their focus is primarily investing not fund raising; where the fund has insider capital and where success is determined by LP value creation not GP fee generation.

Smart investors are attracted to smart firms. We like to see evidence of some stability in the investor base, including repeat investments and/or the presence of ‘smart anchor capital’.

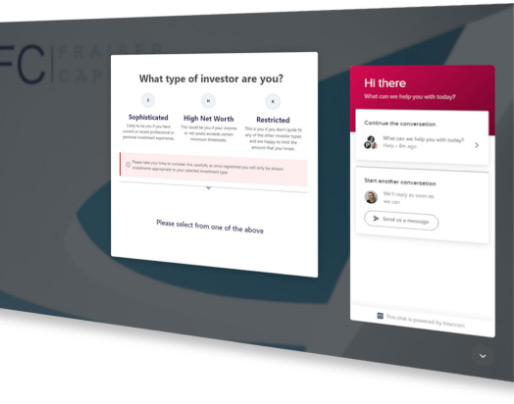

We onboard your team and clients with a firm branded account.

You can add product, facilitate client subscriptions and manage client reporting.

We create a firm branded account.

You can invite clients in and manage which Treble Peak products they can access.