‘If you want good ideas you must have many ideas’ Linus Pauling.

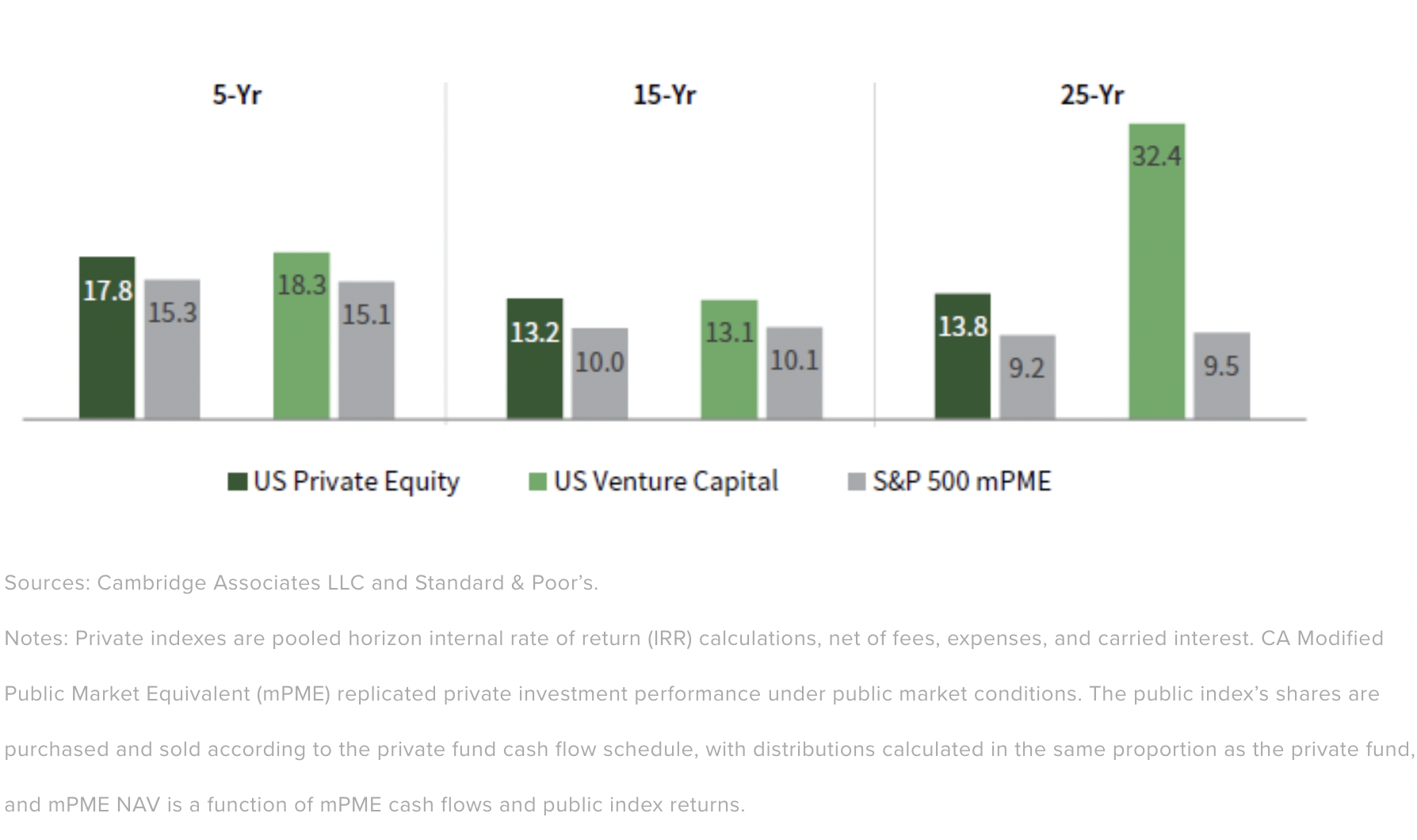

A key ingredient in investment success is repeatability. Past success (past performance if you will) means nothing if the conditions of past success have changed. Much of the material advocating Venture Capital investing (and private markets investing in general) tends to focus on the strong returns generated by investing in Venture Capital1 Sometimes the narrative focus is on specific success stories with a bias towards unicorns2.

Investment advocacy often starts by showing the history of (strong) returns (see the side bar). This appeals to what Daniel Kahneman calls our System 1 thinking3. System 1 operates automatically and quickly with little or no effort and no sense of voluntary control. System 2 requires more effort, more concentration. System 2 is required for more complex computation tasks. System 1 is ‘more influential and is the secret author of many of our choices and judgements’4. A narrative focused on past performance also appeals to our pre- frontal cortex, the one that provides us with a dopamine rush.

Understanding past performance is a necessary part of evaluating most investment opportunities. If nothing else, it provides validation and comfort; but investors cannot eat past returns. To understand the future potential of an investment opportunity we should seek to examine whether past success is repeatable. Will the conditions that led to this success persist or, like success in elite sport, fade?

1 See side bar showing an extract from Cambridge Associates.

2 ‘Unicorn’ is a term used in Venture Capital to describe a startup with a value of over $1billion. There are more than a thousand unicorn companies globally as at March 2022. Source: CB Insights ‘The Complete List of Unicorn Companies’.

3 In his book ‘Thinking, Fast and Slow’ Daniel Kahneman explains that we have two approaches to processing information and making decisions. System 1 (Fast) and System 2 (Slow, methodical).

4 ‘Thinking, Fast and Slow’ Kahneman

This short article seeks to make the case for Venture Capital investing empirically; to test whether the environment will continue to be favourable for Venture Capital success. To interrogate this we start by transporting ourselves back to 16th century Italy, to the Renaissance. Much has been written about this formative and profoundly important staging post in European intellectual history. The Renaissance provides the bridge from the Middle Ages to the modern World.

In their book ‘The Golden Age of Discovery’ Ian Goldin and Chris Kurtana describe the intellectual ferment during this period. They provide an explanation of the flourishing of genius that led to the emergence of radically new thinking during this period which in turn lead to an avalanche of new ideas in all spheres of human life: science, art, philosophy, diet.

Copernicus, Michaelangelo, Da Vinci, Machiavelli, Erasmus, Descartes all lived over 500 years ago, but their impact has lasted centuries, their genius still resonates and their works still admired5. So what was the formula for this sudden flourishing of genius, what were the pre-conditions that catalysed this explosion of new ideas and discoveries over this relatively short period of history?

The answer lies in the convergence of a number of forces ‘that spark this genius’6. The invention of the Gutenberg press was a massive disrupter; it led to communications revolution. The wide and cheaper availability of books and pamphlets, increased literacy and provided easy access to centuries of knowledge. Before the 1450’s an educated person may have read a dozen hand- written books. The knowledge thirsty may have to take a pilgrimage to the Papal Library in Avignon7. By the time of his 50th birthday the person born in 1450 would have access to perhaps 15 to 20 million books; more books were published in one generation then were hand-scribed since Roman times8. The collateral benefit of easily available printing material was the increase in intellectual debate which in turn led to challenge and collaboration; to improvements in prevailing theories and the birth of new thinking. This is the classic (positive) network effect at work.

The second disruptive force was the importation of new ideas and technologies from the New Worlds of Asia, Vasco Da Gama had found his way to India and Columbus (and Cortes) to the Americas. The interaction with other civilisations brought new ideas. For example the sophisticated irrigation techniques of the Aztecs, the advantage of using Hindu-Arabic numerals over Roman numerals (manipulating Roman numbers required an abacus, not everyone had access to one) and the importation of nutritious and calorific foods such as peanuts, sweet potatoes, maize.

The third disruptive force was the beginnings of the philosophical shift from a (Catholic) God centred approach to thinking towards a more rationalist approach; from ‘revelation to observation’9.

As the risk of oversimplifying the formula, the flourishing of intellectual curiosity and genius was:

Gutenberg’s printing press fueled the increase in the availability and velocity of information and knowledge PLUS

The arrival of new and diverse ideas from the New Worlds PLUS

5 This article is a simple summary of the more nuanced and deeper analysis in Goldin and Kurtana. The author strongly recommends the book for those interested and who wish to approach this subject from a Systems 2 lens.

6 Age of Discovery Goldin and Kurtana.

7 Goldin and Kurtana

8 Goldin and Kurtana

9 The Greeks off course ‘did’ science and Maths but the paradigm shifts that began in the 16 Century – eg Copernicus and Galileo were powerful philosophical shifts from the prevailing thinking.

Observation trumping revelation EQUALS

A powerful network effect (more collective brain power) and ultimately the eruption of collective genius. The increase and diversity of ideas results in more ideas mating and generating even more ideas; what Matt Ridley calls ‘ideas having sex’10.

So what does this have to do with investing in Venture Capital? We can draw parallels between the powerful forces that led to the eruption and flourishing of new ideas during the Renaissance and the world we live in today. This is important as it’s the presence of new ideas, of disruptive forces, the flourishing of risk taking that provides sustaining opportunity for Venture Capital.

So what are the ‘parallels’ today?

The modern equivalent of the Gutenberg press are fibre cables (and satellites). The Gutenberg press transformed communications in one generation. The same is happening with the internet. In 2000 6.8% of the global population was using the internet, in 2010 this increased to 29.2%, by 2015 to 43% and today its 65%11. The internet has made information and knowledge ubiquitous – it has reduced the transaction cost of access and increased the spread of information. It has also increased the velocity of the transmission of ideas; not all for the greater good.

The growth in tertiary education has also increased materially over the last couple of decades, and globally. The number of students in tertiary education in 2021 was 200m, up from 100m in 2000. In Latin America and the Caribbean this has doubled in the last decade12. We have more scientists now then all the scientists who ever lived up to 198013. Globally about 3 million students go abroad for their higher education, this is increasing at about 12% per annum14. Not all of them return home. China sent virtually no students abroad 30 years ago, now it sends about 700,00015.

According to Patent Pending How Immigrants are reinventing the American economy, among the top ten patent producing universities in the US, foreign born inventors were named in 75% of the patents. Over 40% of Oxford University staff are foreign from about 100 countries16. A 1999 study showed that one-third of Silicon Valley scientists and engineers were foreign born17. The global drive to diversity and inclusion will continue to add to the cognitive diversity of thinking.

The world is better educated has better brains and is ‘exchanging and exploding a variety of ever more vivid ideas – globally, instantly and at zero cost’18.

The equivalent of the philosophical shift is analogue to digital. Everyone is familiar with Moore’s law; what is perhaps less well known is that we are entering into the second half of the chessboard. In the second half of the chess board the numbers we encounter are difficult for the human brain to comprehend. Futurist Ray Kurzweil’s story (see the sidebar) helps to drive home this point. Moore’s

10 ‘Rational Optimist’ Matt Ridley

11 Internetlivestats.com

12 OECD

13 Goldin and Kurtana

14 Goldin and Kurtana and Daxue Consulting

15 Daxue Consulting

16 Goldin Kurtarna.

17 ‘Silicon Valley’s new Immigrant Entrepreneurs’ AnnLee Saxenian

18 Goldin and Kurtana.

Law is entering the second half of the chessboard which is helping propel new ideas and new inventions. The developments in AI are feeding off this entry into the second half of the chessboard.

We are in sixth century India. The Emperor is impressed with the inventor of the game of chess and asks him to name his reward. The inventor asks for rice, specifically he suggests placing one grain of rice on the first square, two grains in the second square, four in the third square and so on. The Emperor agrees; not realising the full implications of his promise.

After third-two squares (the first half of the chess board) the amount of rice is about 4 billion grains – about the size of a large fields worth. A reasonable amount to comprehend and to honour. However, when we enter the second half of the chess board the numbers become very big. By the time we get to the end of the second half the amount of rice has increased to the size of Mount Everest; this is more rice then has ever been produced in the history of the world!

The Emperor cannot honour his promise and the inventor gets beheaded.

Source: The Second Machine Age by Brynjolfsson and McFee

Genius is not about a handful of ‘great focused minds’, societies leap forward when the conditions are right for collective genius. When we can connect more brains together and using Matt’s Ridley’s analogy, these ideas are allowed to be promiscuous. This results in the network effect and the flourishing of risk and the flourishing of genius. The formula today is a little different from the Renaissance but there are strong parallels.

We are experiencing the impact of the growth in new ideas and new approaches every day19. This is not just in sectors like entertainment and consumer but also in fields like education where technology is providing access to high quality teaching and helping students reach their full potential. The healthcare sector is also evolving rapidly with data driven AI improving diagnoses, pocket sized ultra sound devices reducing costs and we are at the early stages of harvesting the completion of the human genome project.

Looking forward we have big societal issues to deal with. Some are policy related like social justice, many, like the transition to net zero, will require significant capital investment and where innovation will be a key parameter of success20. If proof were needed of the level of ideas generated we need only look at the US patent office. In 2000 there were about 315,000 patents filed. In 2020 this had increased to about 646,000.

This provides for a very fertile environment for Venture Capital investing. We need not worry about repeatability. The conditions for success in Venture Capital investment are likely to persist. As ever with investing, selection is important. This will be something we return to.

Divyesh

4 May 2022.